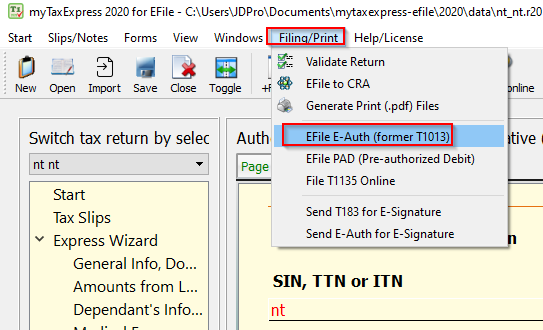

How to efile e-auth (former T1013) to CRA?

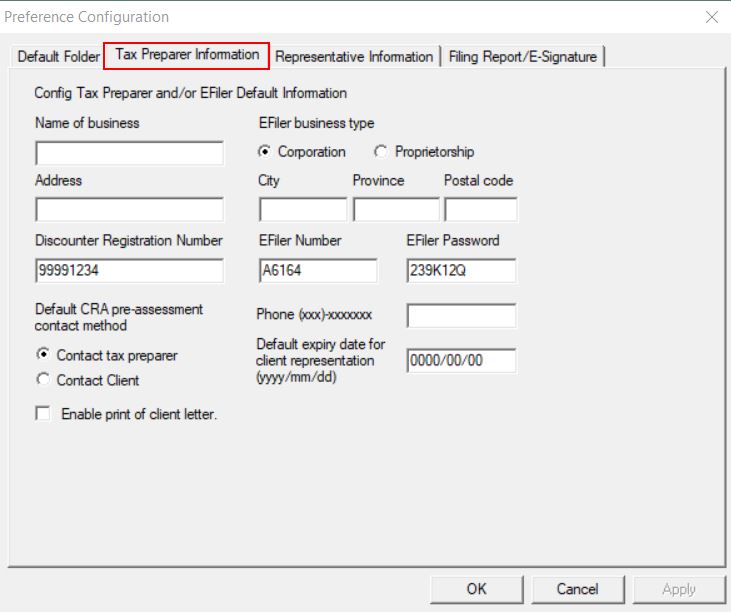

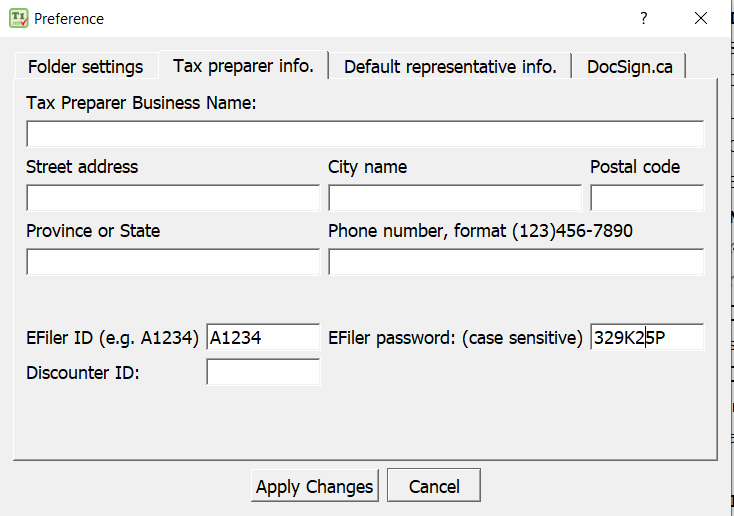

Efiling e-auth(T1013) to CRA is a side function of the myTaxExpress EFile software. You need to have CRA EFiler ID/Password first, and set them in software preference by menu "Start | Preference", then "Tax PreParer Information" tab (Version 2019 and prior) or "Preferences" icon on the icon bar (Version 2020 and later).

![]()

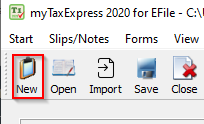

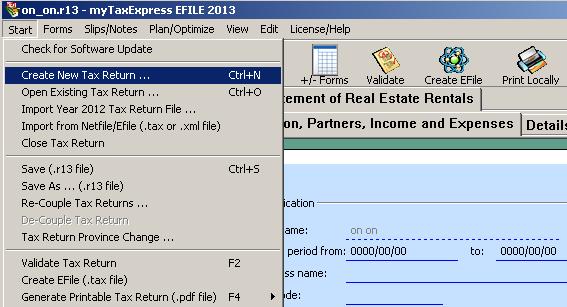

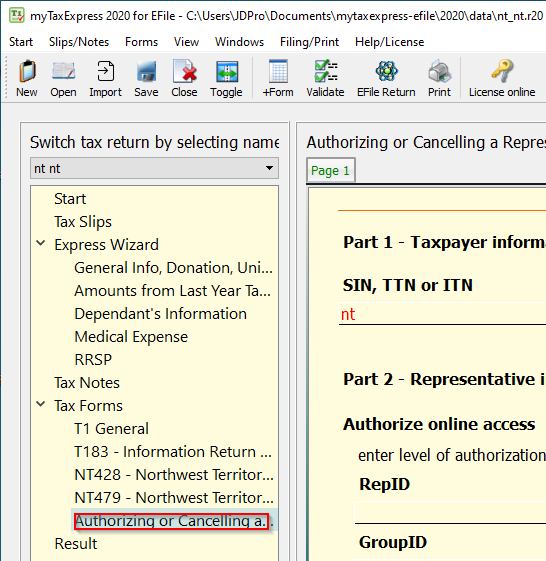

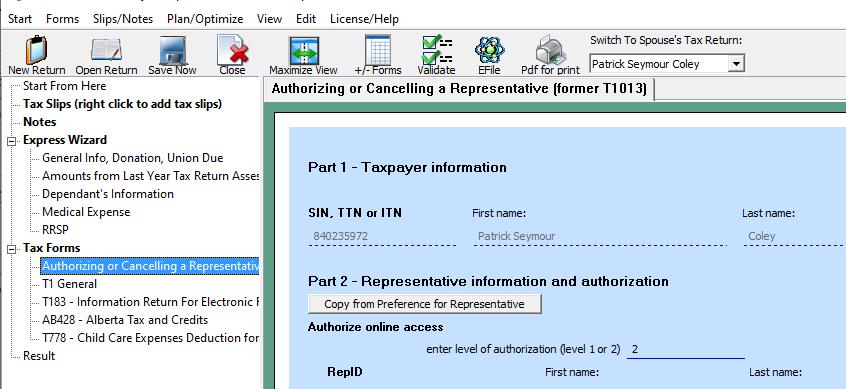

Next, you need to create an empty tax return for the client. The client's name and S.I.N information must be correct. Since e-auth doesn't need a birthdate, marital status, and tax province information, you can choose anything when creating such an empty tax return. The tax return is just a place to hold a form of Authorize a Representative (former T1013).

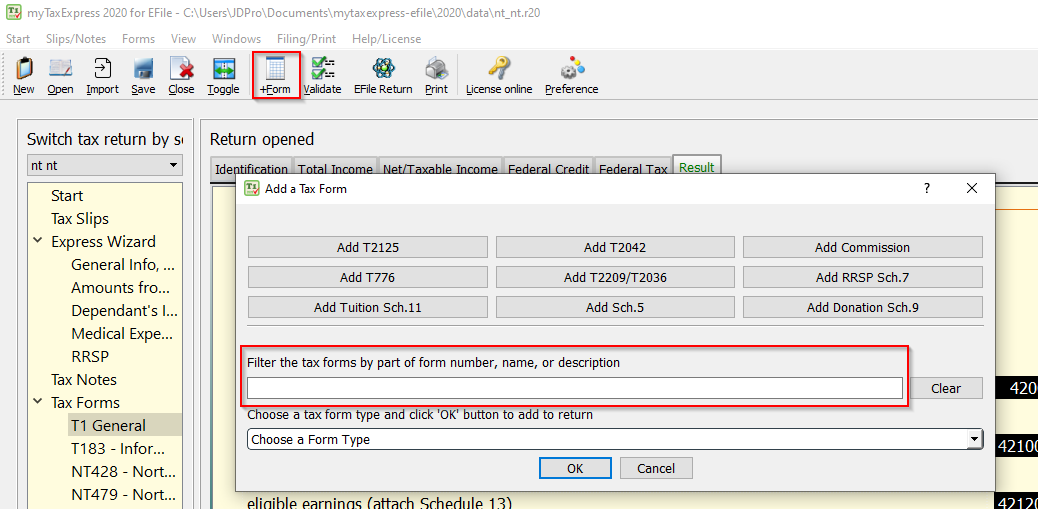

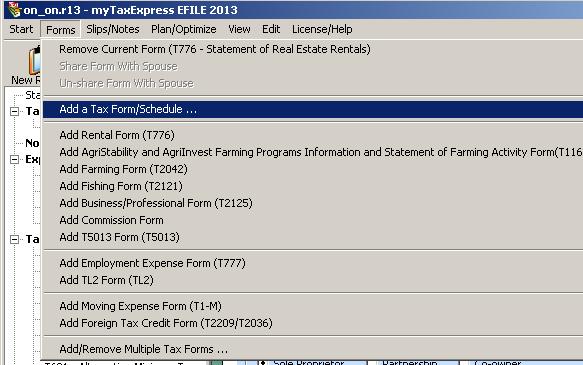

Next, you need to add a form "Authorize a Representative" into this return by menu "Forms | add a tax form". Complete all the required information inside "Authorize a Representative".

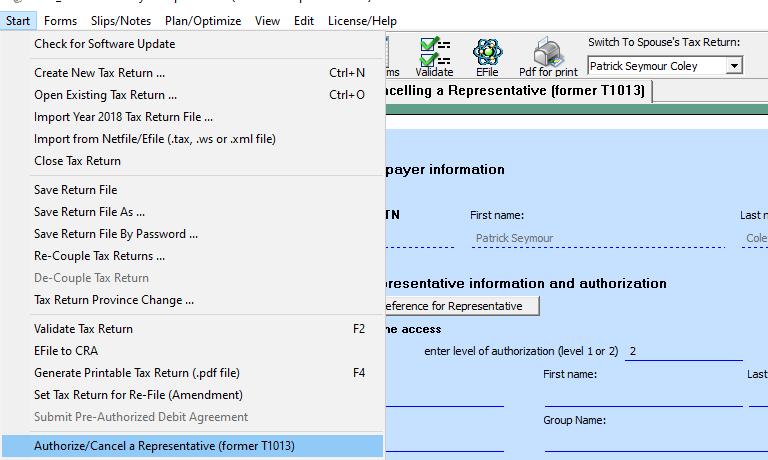

Last, you submit the completed form to CRA by choose menu "Start | Authorize a Representative".

Last note, Filing E-Auth will not contain any T1 tax return information to CRA.