How to report capital loss and apply loss from previous years?

If you have a net capital loss from Schedule 3, the loss will NOT be transferred to field 12700 (127 in older years) because the capital loss cannot be applied to reduce taxable income directly. You can only apply capital loss to prior/future capital gain.

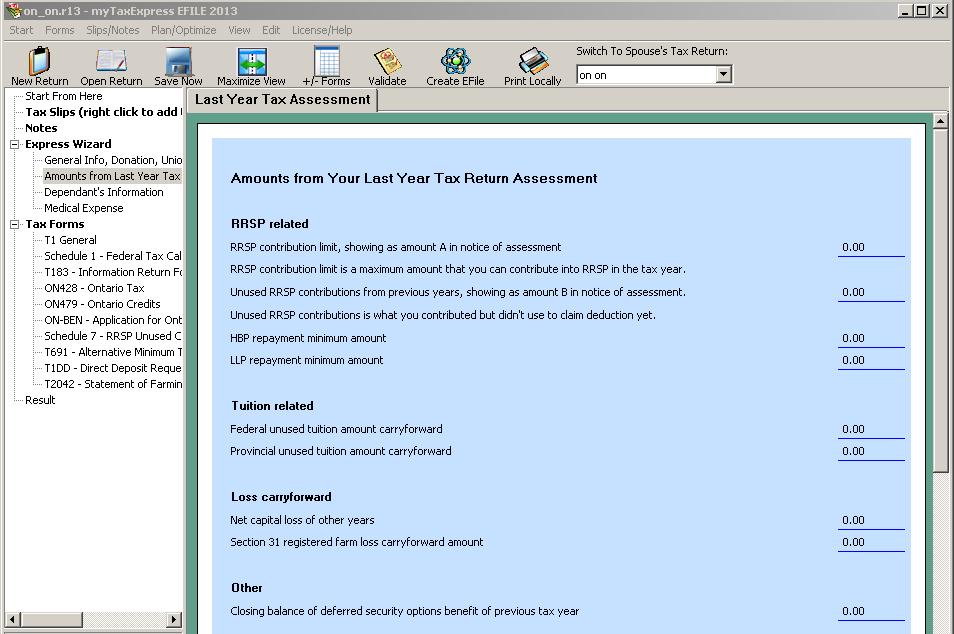

You can enter the balance of unused capital loss from previous years into the wizard of "Amounts from Last Year Tax Return" page.

If you have capital gain in the tax year, then you can claim accumulated capital loss up to the capital gain amount into field 25300(253 before the year 2019) of T1.

Net capital loss can only be reported against capital gain at field 12700 (127 before the year 2019) of T1; it cannot be used to reduce other income. So you need to have a capital gain in the tax year to claim net capital loss from previous years.