How to Re-File (Amend) a T1 tax return?

For tax year 2015 and prior year's tax return, ReFile function doesn't work. Please still use T1-Adj form or CRA web portal to amend tax return (Read this link for more information).

From the tax year 2016, you can Re-File (Amend) an assessed T1 return; The process is like submitting Netfile or EFile again. The following conditions must be met before you can Re-File:

- CRA has completed the assessment or re-assessment of the initial T1 return.

- If you are using EFile, you might need to have a valid form E-Auth (T1013) authorization on file for the taxpayer with the CRA. So you can Re-File to amend the tax return. myTaxExpress EFile software can submit E-Auth (T1013) authorization online as a separate step.

To Re-File a tax return, follow these steps:

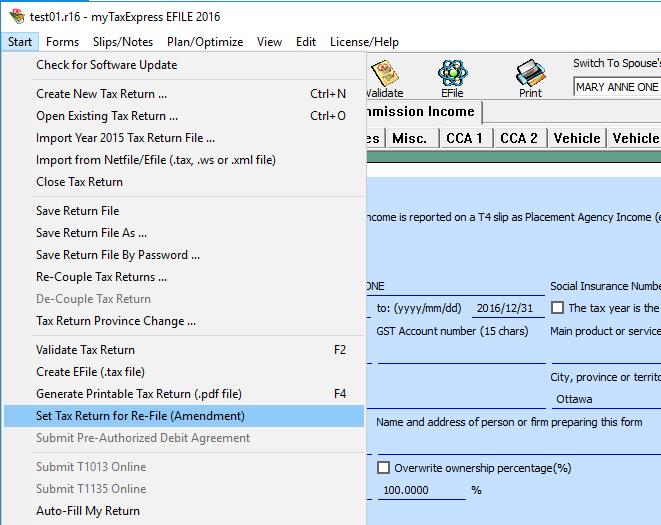

- First, open the return file for ReFile, and choose the menu "Start | Set tax return for Re-File".

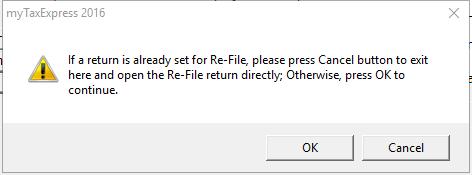

- If you already set this return for Re-File, you will get the following warning message. In other word, you only set tax return for Re-File once in the beginning.

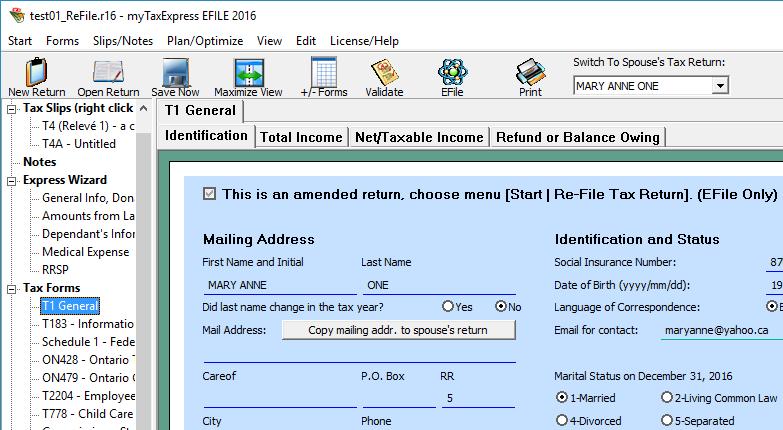

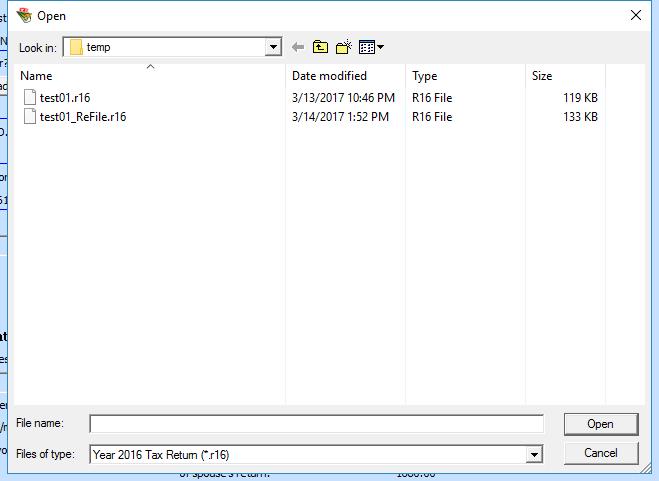

- It will create a new tax return file, adding "_ReFile" in the file name for Re-File purpose. The original tax return file is untouched, so you can reference the original file in the future.

You can see a new file is created for Re-File purpose. Next time, you can simply open this file, no need to use the menu "Re-File" again.

- Complete the tax return as if you are filing a T1 return for the first time.

- At last, choose menu "Start | Create NetFile/EFile" or "Start | Netfiel/EFile to CRA" to NetFile/EFile the amended return.