How the personal amount is prorated?

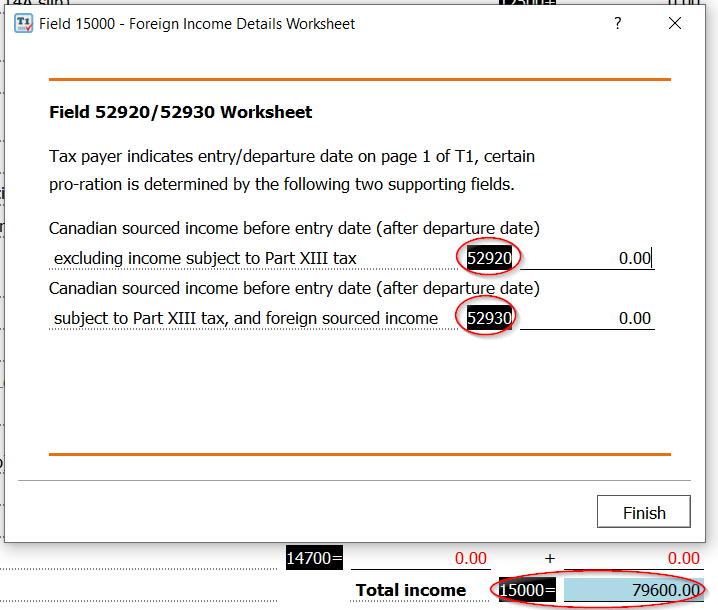

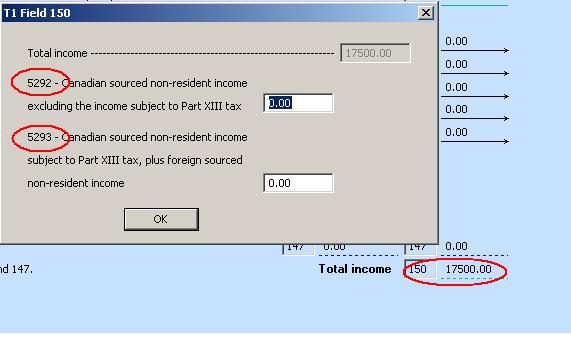

Note: Since the Year 2019, fields are named by 5-digit.

Field 300 in Schedule 1 is the personal amount. If taxpayer becomes or ceases to be a resident of Canada in the tax year, this amount might be pro-rated. Since the tax year 2013, there are some new changes to this field.

Before tax year 2013, this field is pro-rated for the days the taxpayer resides in Canada divided by 365(366) days in the tax year.

Since the tax year 2013, the following new rule comes in effect: (also see CRA guidance for this topic: immigrant and emigrant)

When a newcomer to Canada claims an immigration entry date, the software must determine if the Non-refundable proration rule is met as the following:

F5292 divided by (F5292 + F5293). When this amount is 90% or greater, the software must calculate the full non-refundable amounts; however, if this calculates to less than 90% the software must prorate the non-refundable amounts based on the number of days living in Canada.

In simple words, Field 5292 (52920) is your income earned from Canada while you are non-resident; Field 5293 (52930) is the income you earned outside Canada while you are non-resident.

You can find field 5292 (52920) and 5293 (52930) by clicking mouse into field 150 (15000) on page 2 of T1.

Version 2020 and later(Click to view)

Version 2019 and prior (Click to view)

The non-refundable fields that must be prorated if the 90% rule is not met are:

a. F300, basic personal amount

b. F301, age amount

c. F303, spouse or common-law partner amount

d. F305, amount for an eligible dependant

e. F306, amount for infirm dependants

f. F318, disability transfer from dependant

g. F324, tuition, education, and textbook amounts transferred from a child